REIT Investing

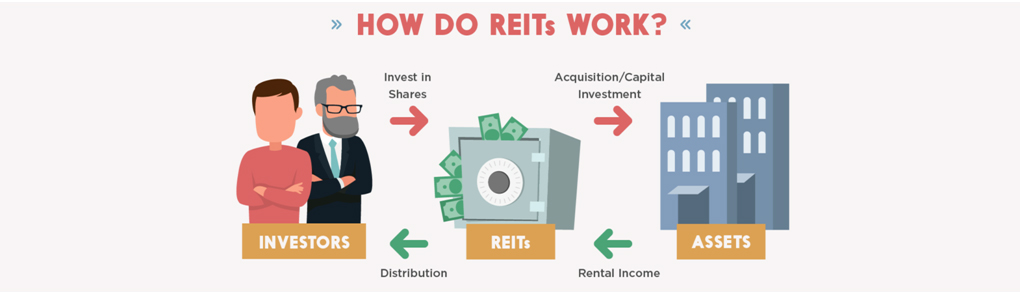

REIT Investing (real estate investment trust) may be one of the best passive income investments because REITs are legally required to pass their profits on to shareholders. With REITs, you can invest in real estate without ever having to buy and manage property. The REIT is simply a company that owns and operates properties and is traded publicly as a stock.

REITs can be focused on various types of properties, including apartments, office buildings, medical complexes, warehouses, and more. They can also be investments that pay monthly dividends. Some even own cell phone towers. There are three main types of REITs-equity, mortgage, and hybrid-each of which we’ll break down in our income investing guide.

REIT Investing (real estate investment trust) may be one of the best passive income investments because REITs are legally required to pass their profits on to shareholders. With REITs, you can invest in real estate without ever having to buy and manage property. The REIT is simply a company that owns and operates properties and is traded publicly as a stock.

REITs can be focused on various types of properties, including apartments, office buildings, medical complexes, warehouses, and more. They can also be investments that pay monthly dividends. Some even own cell phone towers. There are three main types of REITs-equity, mortgage, and hybrid-each of which we’ll break down in our income investing guide.