Bond Investing

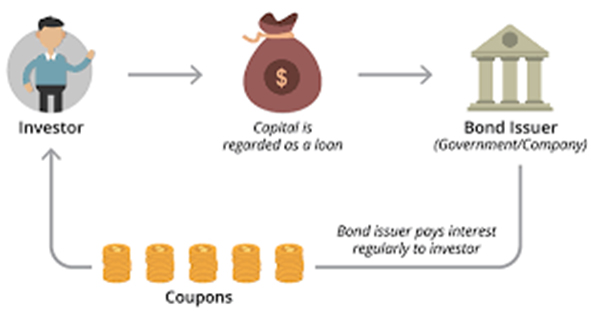

Bonds are simply loans given from an investor to a borrower. Typically, the borrower is a corporation or governments who seek loans to grow their business or fund infrastructure. The borrower sets the term of the bond which includes the interest rate and the maturity date and borrowers will get their investment back if they hold until maturity. Borrowers can also get interest payments over the life of the bond.

The higher the interest payments, the riskier the bond, which is important to understand as a borrower. There is potential that your investment isn’t repaid. Corporate bonds are typically riskier than government bonds, but government bonds also pay much lower interest rates. Additionally, the borrower’s credit and the length of the maturity date affect the interest rate, with lower credit and longer maturity leading to higher interest.